|

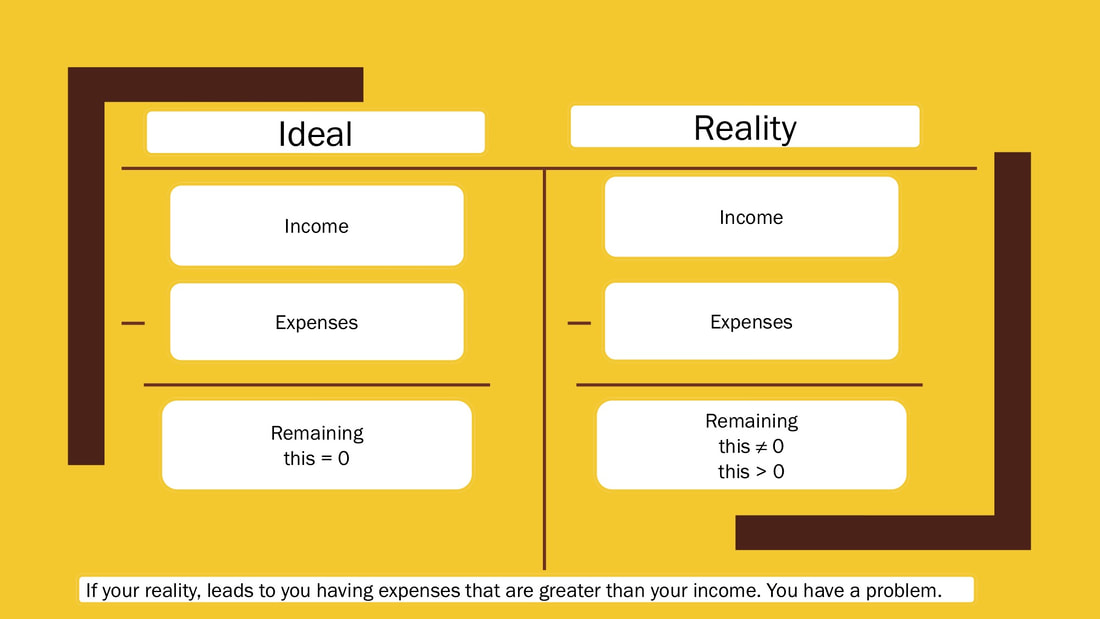

What if I told you that only 41% of Americans have a budget? (U.S. Bank) Say what?!?! People are just rolling the dice hoping they reach there financial goals. So many things in this world are driven off of our need to spend money. The best way to counter this is to create robust budget. In this post, I will discuss 3 benefits of budgeting. Makes you aware of your SpendingA budget allows you to be aware of your spending habits and how these spending habits are impacting your life. The biggest item is overspending on things such as groceries or personal things such as eating out or going to the movies. All of these things can have an impact on your monthly allocation of your money. Most people are never aware of their overspending because they fail to keep detailed tracking of their spending. While those who budget are able to see the larger picture of how their money is behaving. From the moment you get paid (Income) to the paying of your bills (Expenses), you will be able to visually see if you have remaining money that is not working for you or if you are over paying on things such as transportation. Helps you Pay Off Debt fasterBudgeting allows you to pay off your debt faster (if you have any) or allow you to save more effectively and efficiently. This allows you to spend your money on things that are beneficial like food on the table, roof over your head, that much needed car, or even that dream vacation. When you are aware of your expenses and how it impacts your income; you will be more inclined to not live above your means. Allows you to reach your GoalsOnce you are aware of your spending habits, you now gained the power to allocate that money and allow for it to work for you. Emergencies are no longer a set back because you will have the money to pay for that tire or that new AC Unit for your home. I hope that you all enjoyed and that you remember to live your life the best way that you can and not for others.

0 Comments

Leave a Reply. |