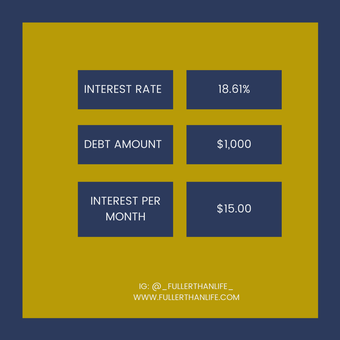

Even with amazing credit most people pay interest on auto loans, home loans, and credit cards. Interest rates are so ingrained in our money system and directly tied to your credit. Unless you can afford to pay for a home or car (this can be accomplished with a house fund) then you need credit to lower your interest rates. Wonna know more about Credit? Check out this short video I put together. Watch via IGTV or YouTube.  Let's unpack the example here. You spend $1,000 on your credit card. You bought a pair of shoes here, got some gas there, had to replace your battery that one time...then boom your credit now has a $1,000 credit card balance. Sooo let us assume you are paying the national interest rate of 18.61% a month on your purchases. Sis, that is $15.00 a month. You only pay $25 or $35 dollars as a down payment which means that you are literally paying for the interest each time you make a payment. That means when you make your payment each month that only about 40% to 60% of your payment is going towards the debt and the remaining 40% to 60% is going towards the debt. Like it is literally set up for you to stay in debt if you are only paying the minimum! How can you avoid the trap? ✔️Only spend what you can afford to pay back. ✔️If shopping with a Credit Card, then pay it off each month. ✔️If you want a new car, then create a car fund. This will allow for you to pay nothing or a low amount at purchase. ✔️If you want to buy a house, then create a house fund. Realistically, most people will still need a home loan. If you can afford the home loan payments for 15 years instead of the traditional 30 years, then jump on that offer. Interest accumulates and the longer it has to grow the more you pay. Going to a 15 year home loan vs a 30 year loan can easily save you over $100,000. ✔️Make extra payment on your debts when you can ✔️If you are lucky enough to snag a 0% interest rate, then pay it off before the interest starts. Let me know if interest has ever snuck up on you!

0 Comments

Leave a Reply. |